Excellent service

They found me the best rate for the type of annuity that I wanted, and they were able to offer me several types such as fixed, index linked or level plan.

#####

If you’re aged 55+ and are looking to turn your ‘defined contribution’ pension pot into income, a lifetime annuity could be the answer.

With a lifetime annuity, you’ll know exactly how much income you’ll receive each month, for the rest of your life. This means you’ll be able to budget accurately, with the peace of mind of a regular, guaranteed income.

As with all annuities, and unlike some other pension options, you won’t need to worry about investment risk - there isn’t any! The annuity rate and income you receive will be based on a locked-in rate and won’t be affected by investment fluctuations.

When you decide to turn your pension pot into income, you have a number of options. Some of these – including income drawdown – involve keeping your money invested. That works for some people, but not everyone wants the uncertainty of having their pension savings invested.

That’s why you may prefer to turn some or all of your pension pot into guaranteed income with a lifetime annuity. As with all annuities, this provides certainty that your income won’t be affected by fluctuating interest rates or investment market ups and downs.

Being certain of your income in advance means you can budget effectively, with certainty about your income. In the same way, you can choose a death benefit option that will continue to pay a loved one guaranteed income after you pass away.

A lifetime annuity blends the benefit of guaranteed income with simplicity:

Guaranteed income for the rest of your life.

Ideal if you don’t want to subject your pension savings to investment risk

Peace of mind that your money won’t run out.

No need to monitor and manage investment performance.

Setting up your retirement income is a big decision, so it’s good news that our annuity comparison partners enjoy great feedback and an ‘excellent’ Trustpilot rating from customers who have used the service.

They found me the best rate for the type of annuity that I wanted, and they were able to offer me several types such as fixed, index linked or level plan.

#####

My options were discussed with me and I was supported in making the best decision. Impartial and guided me through a very complex process.

######

My options were explained clearly and without pressure. Once I made my decision to go ahead with the product chosen, things moved quicker than I expected.

#####

The concept of a lifetime annuity is very simple: you buy one with your pension savings to lock in guaranteed income for life. But you also have options that bring you flexibility about setting up your income.

You can choose either a ‘level’ annuity where your income stays the same for life, or an ‘escalating’ annuity where payments start lower, but increase each year. The rate of increase can be fixed (e.g. 3% a year) or it can be linked to inflation.

Lifetime annuities also give you the option of death benefits, where someone else receives some or all of your pension when you pass away. Typically, choosing to add death benefits to your annuity will reduce the level of regular income you receive while you are alive.

One more thing to mention is that a conventional lifetime annuity is based on the assumption that you don’t have any significant health problems or make certain lifestyle choices such as smoking. However, you could be eligible for more income with an enhanced annuity if you have a history of certain medical conditions or lifestyle choices.

As with most decisions about financial matters, you do need to weigh up the pros and cons of a lifetime annuity. Although the reassurance of guaranteed income for life may be attractive, there are potential disadvantages to consider:

Once it’s set up, you typically can’t change your lifetime annuity or opt for a different income product.

Inflation reduces the real value of a level annuity income over time.

By default, a lifetime annuity won’t have death benefits and when you die the income payments stop. However, as mentioned above, you can choose to include death benefits in your annuity.

You won’t benefit from investment growth on your pension fund: with an annuity you swap investment ups and downs for guaranteed income.

Some older pension schemes may come with 'safeguarded benefits' such as a guaranteed annuity rate (GAR) or guaranteed minimum pension (GMP) that could pay more income than you'd get elsewhere. Also, some schemes let you take more than the standard 25% tax-free cash lump sum. Always check whether you have any safeguarded benefits and, if you do, take that into account when comparing what your scheme offers with what's available from annuity providers.

Your regular income from a lifetime annuity will depend on several factors. These include the size of your pension savings, your age, and the annuity rate offered by your chosen annuity provider.

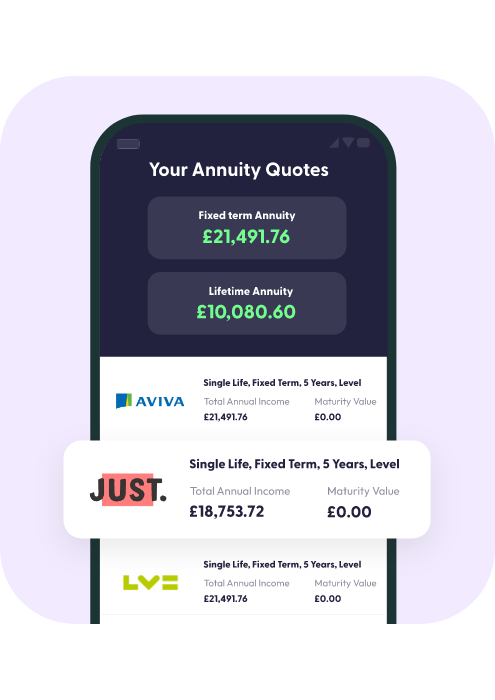

Many providers offer lifetime annuities, and there can be big differences between them in terms of the annuity rate and income they offer. This is why shopping around annuity providers is so important

Thankfully, it’s very easy to find out how much income you can receive for life by turning pension savings into a lifetime annuity. Use our comparison service for an estimate of your potential lifetime annuity income.

At Compare More we bring you quotes from the UK’s leading annuity providers. To help us show you quotes to match your circumstances and needs, we need to know:

The older you are, the higher your regular income payments will typically be.

The bigger your pension fund, the more income you can receive.

We also need some basic contact details so we can send you more detailed information about your quotes.

“Shopping around providers for the best annuity rate is essential when buying a lifetime annuity. It’s recommended by the Financial Conduct Authority and other independent authorities on pension matters. Remember, the rate you get will be locked in for life. Even a small difference in the rate you are offered can add up to thousands of pounds in extra income over the years ahead.”

Guest Contributor, Pensions

Explore your annuity options to find one that’s best for you.

Page updated on 30th July 2025, Reviewed by Richard Groom