Excellent service

They found me the best rate for the type of annuity that I wanted, and they were able to offer me several types such as fixed, index linked or level plan.

#######

If you're aged 55 or over and seeking to convert your 'defined contribution' pension pot into guaranteed income for a specific period, a fixed-term annuity could be suitable.

Unlike a lifetime annuity, which provides income for life, a fixed-term annuity offers guaranteed income for a predetermined term, typically between one and 25 years. This allows you to secure an income for a term of your choosing knowing that it’s locked in and won’t be affected by ups and downs of investment performance.

As with other annuities, after taking up to 25% of your pension savings as a tax-free lump sum, you can use the rest to provide your guaranteed income. But there’s a great bonus feature: you can also allocate some or all of your money to grow, locking-in a guaranteed cash lump sum at the end of the annuity term

When you decide to turn your pension pot into income, you have a number of options. Some of these – including income drawdown – involve keeping your money invested. That works for some people, but not everyone wants the uncertainty of having their pension savings invested.

That’s why you may prefer to turn some or all of your pension pot into guaranteed income with an annuity. Your income won’t be affected by fluctuating interest rates or investment market ups and downs.

But a fixed-term annuity isn’t just about locking in guaranteed income. You can also lock in a guaranteed return (a cash lump sum) on some or all of your pension savings. Once the fixed term is up, you can choose what to do with your lump sum: buy another annuity, take it as cash subject to tax, or explore other retirement income products.

Key benefits of a fixed-term annuity include:

Guaranteed income for a specific period.

Flexibility to make new financial decisions at the end of the term.

Option of a guaranteed lump sum with no exposure to investment market volatility.

Potential to bridge an income gap until other retirement benefits commence, such as the State Pension.

Built-in death benefits so that your beneficiary benefits from your pension after you pass away.

Setting up your retirement income is a big decision, so it’s good news that our annuity comparison partners enjoy great feedback and an ‘excellent’ Trustpilot rating from customers who have used the service.

They found me the best rate for the type of annuity that I wanted, and they were able to offer me several types such as fixed, index linked or level plan.

#######

My options were discussed with me and I was supported in making the best decision. Impartial and guided me through a very complex process.

########

My options were explained clearly and without pressure. Once I made my decision to go ahead with the product chosen, things moved quicker than I expected.

#######

The concept of a fixed-term annuity is very simple: you buy one with your pension savings to lock in guaranteed income. But you also have options that bring you flexibility about putting your pension savings to work.

You can choose either a ‘level’ annuity where your income stays the same every year, or an ‘escalating’ annuity where payments start lower, but increase each year. The rate of increase can be fixed (e.g. 3% a year) or it can be linked to inflation.

Another option is whether you use all of the money you allocate to a fixed-term annuity to generate income, or use some to guarantee a lump sum at the end of the term. You can even take zero income to maximise the size of your lump sum.

And of course, you also get to choose the term of your annuity. So you could use a fixed-term annuity to ‘bridge a gap’ until you start receiving income from another source, such as a final salary pension or the State Pension.

As with most decisions about financial matters, you do need to weigh up the pros and cons of a fixed-term annuity. Although the reassurance of guaranteed income for a set term may be attractive, there are potential disadvantages to consider:

Unlike lifetime annuities, fixed-term annuities stop paying income once the term ends, rather than paying you for life.

If you live longer than expected, a fixed-term annuity might provide less income over your lifetime compared to a lifetime annuity.

Inflation reduces the real value of a level annuity income over time.

You won’t benefit from investment growth on your pension fund: with an annuity you swap investment ups and downs for guaranteed income.

Some older pension schemes may come with 'safeguarded benefits' such as a guaranteed annuity rate (GAR) or guaranteed minimum pension (GMP) that could pay more income than you'd get elsewhere. Also, some schemes let you take more than the standard 25% tax-free cash lump sum. Always check whether you have any safeguarded benefits and, if you do, take that into account when comparing what your scheme offers with what's available from annuity providers.

Your regular income from a fixed-term annuity will depend on several factors. These include the size of your pension savings, your age, your chosen term, whether you want a guaranteed lump sum at the end of the term, and the annuity rate offered by your chosen annuity provider.

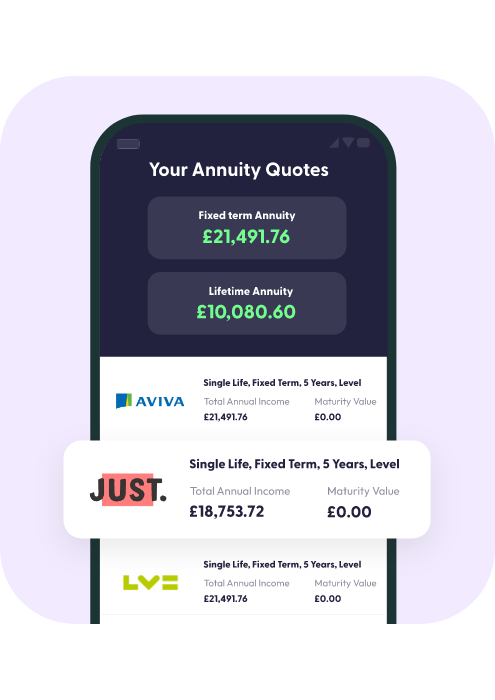

A number of providers offer fixed-term annuities, and there can be big differences between them in terms of the annuity rate and income they offer. This is why shopping around annuity providers is so important.

Thankfully, it’s very easy to find out how each provider stacks up when it comes to offering you a fixed-term annuity. Use our free comparison service for an estimate of your potential annuity income.

At Compare More we bring you quotes from the UK’s leading annuity providers. To help us show you quotes to match your circumstances and needs, we need to know:

The older you are, the higher your regular income payments will typically be.

The bigger your pension fund, the more income you can receive.

We also need some basic contact details so we can send you more detailed information about your quotes.

“Has your pension scheme offered you an annuity? Look closely at their offer, as you might be surprised at the difference between the lowest and highest annuity rate available from different providers. Just as importantly, you may find that your pension scheme or the provider they refer you to doesn’t offer a fixed-term annuity - so please look at other providers if that’s an option you want to explore.”

Guest Contributor, Pensions

Explore your annuity options to find one that’s best for you.

Page updated on 30th July 2025, Reviewed by Richard Groom